Je peux t'aider à trouver un financement facilement pour ton nouveau véhicule.

Fais une demande de préapprobation gratuite et sans obligation

afin que je puisse t'aider personnellement à trouver ton prochain véhicule au bon prix.

Tu aimerais savoir combien tu peux emprunter

pour acheter ton prochain véhicule?

Je t'offre un service d'analyse de crédit automobile gratuit pour t'aider à acheter

un bon véhicule selon tes besoins et ton budget mensuel.

Du bureau de Mario Jr. Duquette "le gars de crédit oui"

Depuis mes débuts en automobile, j'ai pu aider plus de 1 000 acheteurs à trouver un financement automobile abordable, peu importe leur situation.

En plus, je le fais de la même façon que j'aime être servi lorsque j'achète quelque chose : Avec respect et transparence.

Alors si vous avez été refusé dans un autre concessionnaire automobile, que vous avez fait faillite, que ton crédit n'est pas parfait et si tu te demande combien tu pourrais obtenir de la banque pour ton prochain véhicule, communique avec moi directement afin que je puisse t'aider.

Je peux t'aider à acheter un véhicule même si :

Ton score de crédit

n'est pas parfait

Tu as déjà déclaré faillite

dans le passé

Tu as été refusé dans un autre concessionnaire

Tu aimerais savoir si tu peux acheter le véhicule parfait pour tes besoins et ton budget?

Commence ta pré-approbation gratuite afin que je puisse t'aider à acheter ton prochain véhicule :

Chaque situation est différente!

Je compte maintenant près de 10 ans d'expérience dans le domaine, et je pourrais affirmer que j'ai presque tout vu!

Je peux t'aider si vous êtes dans cette situation :

- Refus dans un autre concessionnaire

-

Taux d'intérêt élévé sur votre véhicule actuel

-

Ton véhicule coût cher en réparations

-

Tu veux financer un véhicule mieux adapté à tes besoins

- Tu aimerais réduire tes mensualités

Les avantages que je t'offre en tant que client VIP

Transaction transparente, rapide et simple

Taux d'intérêt à l'achat à partir de 3.99%

Accés VIP à plus de 2 000 véhicules chaque mois

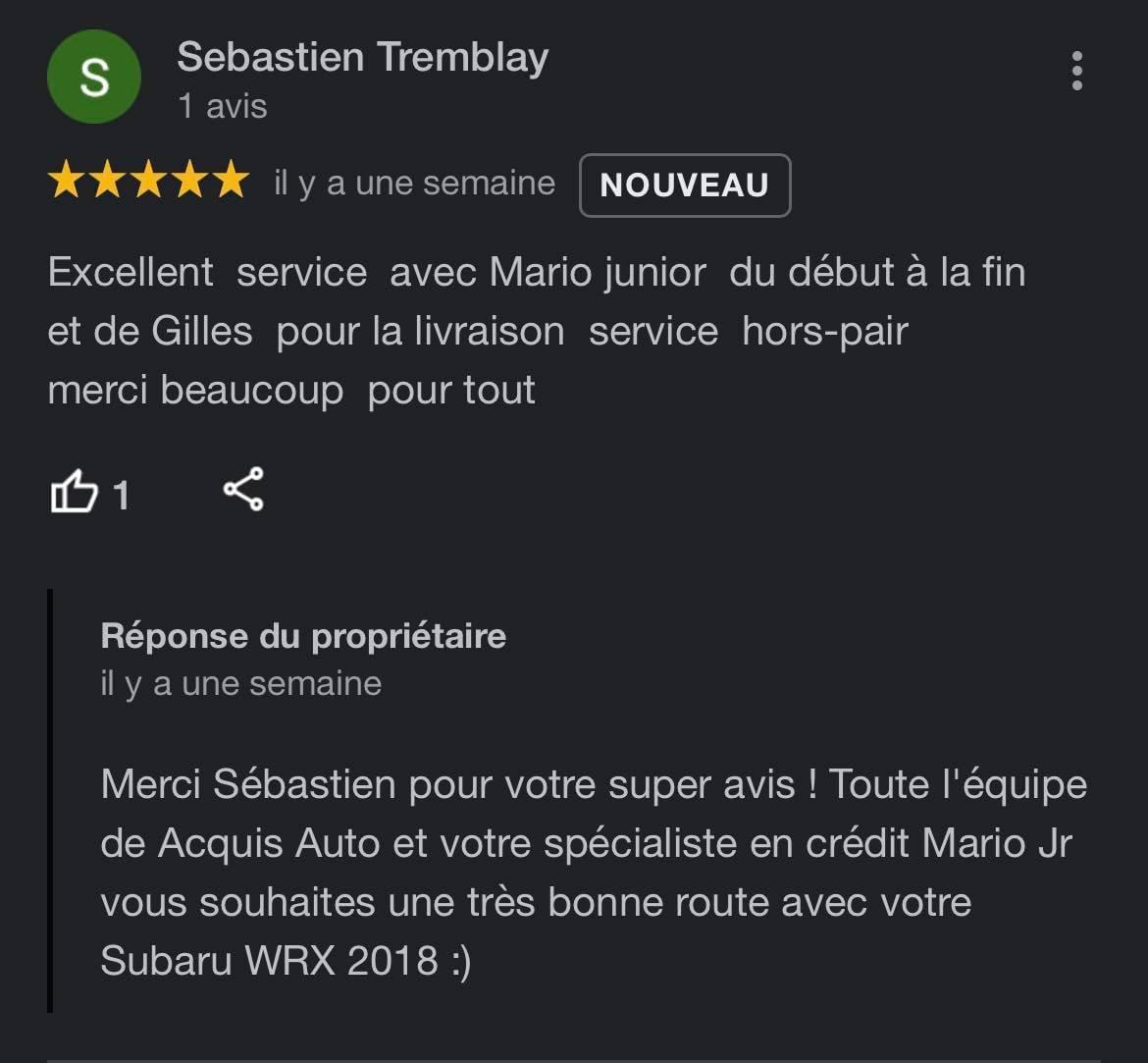

DES CENTAINES DE CLIENTS SATISFAITS CHAQUE ANNÉE

ÇA NE S'INVENTE PAS :D

PRÊT À PASSER À L'ACTION?

Répondez à quelques questions simples et rapides afin d'obtenir une pré-qualification, des conseils et un service personnalisé en route vers l'acquisition de votre nouvelle voiture!

2022 © legarsdecreditoui.com

Tous droits réservés